EXXARO DELIVERS POSITIVE RESULTS DESPITE CHALLENGING OPERATIONAL AND MARKET CONDITIONS

SALIENT FEATURES

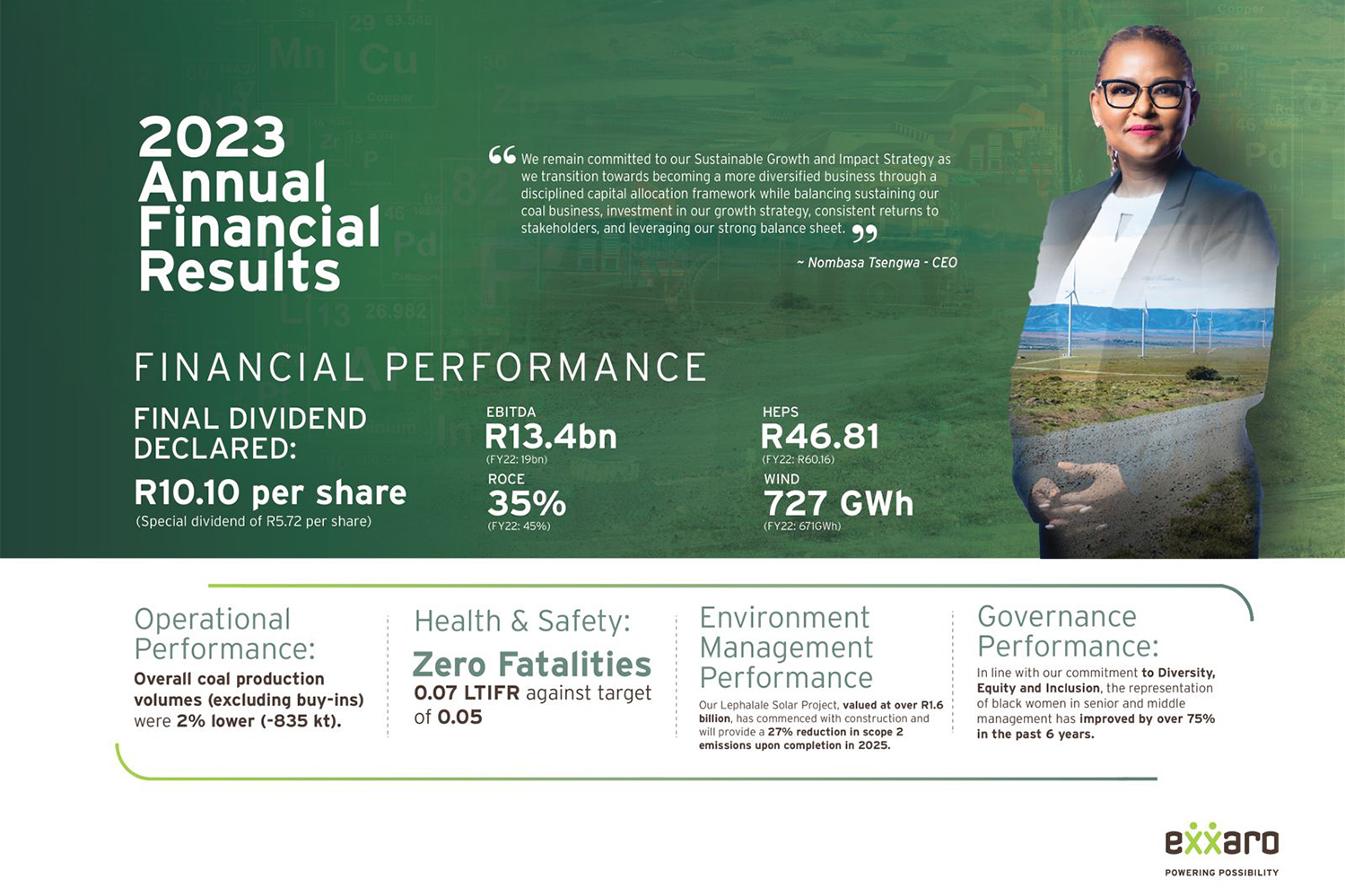

- Zero fatalities during the reporting period

- 0.07 LTIFR, against a target of 0.05

- Group Revenue of R38.7 billion, down 17% [FY22: R46.4 billion]

- EBITDA of R13.4 billion, down 29% [FY22: R19 billion]

- HEPS at R46.81, down 22% [FY22: R60.16]

- Net cash position of R14.8 billion, excluding Energy’s net debt of R4.3 billion [FY22: net cash of R9.6 billion, excluding Energy’s net debt of R4.4 billion]

- Final cash dividend of 1 010 cps [FY22: 1 136 cps], down 126 cents y-o-y

- Special cash dividend of 572 cps

- Direct social impact contribution of R 1.9 billion

14 March 2024, Exxaro Resources Limited (Exxaro), the black empowered diversified resources and renewable energy group, reported its second highest EBITDA performance of R13.4 billion (FY22: R19 billion) and HEPS of 46.81 (FY22: R60.16) for the financial year ended 31 December 2023, a robust performance despite lower export prices and lower domestic and export sales volumes, demonstrating the exceptional performance of its coal business, driven by high-quality product mix.

Speaking on the results, Exxaro’s Chief Executive, Nombasa Tsengwa said, “We remain confident in our ability to foster value creation as shown by our FY23 financial performance. Yet again, we have maintained our stakeholder returns, robust balance sheet and strong cash flows despite the fluid market and challenging environment. We remain focused on embedding efficiencies and governance excellence in our operations. This, coupled with our Early Value Strategy and Market-to-Resource optimisation strategy placed us in a strong financial position and I am happy to announce that our Board approved a share dividend of R10.10 per share (which is approximately R3.4 billion) and on top of that, approved a special dividend of R5.72 per share (approximately R2 billion) in line with our strategic approach to capital allocation. In addition, safety and zero harm remain critical performance indicators for our business sustainability. This year we turned our focus back to basics and reported zero fatalities for 2023 and our LTIFR was 0.07 against a set target of 0.05. In addition, our direct social investment was R1.9 billion.”

Financial results: Group revenue for FY23 declined 17% to R 38 398 million [FY22: R46 369 million] as a result of the significantly lower export sales prices achieved due to the steep decline in the API4 index price which averaged US$121 per tonne [FY22: US$ 271 per tonne]. This was partially offset by a weaker exchange rate and higher prices achieved on domestic sales.

Headline earnings decreased by 22% to R11 327 million [FY22: R14 558 million] driven mainly by the 29% decrease in Group EBITDA to R13 399 million [FY22: R19 002 million] and 4% decrease in adjusted equity-accounted income. SIOC’s adjusted equity-accounted income increased by 26% due to higher iron ore prices, sales volumes and cost optimisation initiatives, which were offset by a 73% decrease in Mafube’s (our 50% JV with Thungela) adjusted equity-accounted income, mainly due to lower export prices.

The decrease in earnings translated into headline earnings per share (HEPS) of 4 681 cents [FY22: 6 016 cents], 22% lower than the prior year.

Exxaro remains prudent in its strategic approach to capital allocation, in terms of returning cash to shareholders, managing debt, and selectively reinvesting for the growth of the business in a low carbon future.

Cash generation by operations declined 29% to R13 307 million [FY22: R18 863 million] and together with dividends received from equity-accounted investments of R4 911 million [FY22: R5 903 million] was sufficient to fund capital expenditure, tax paid and ordinary dividends paid. This strong cash generation resulted in a net cash position of remains position of R14 834 million (excluding Energy’s net debt) compared to a net cash position of R9 645 million on 31 December 2022 (also excludes Energy’s net debt).

Coal business performance: Coal production volumes from operated mines (excluding third party buy-ins) decreased by 2% to 42.5 Mt, mainly due to lower production at Grootegeluk, Mafube and Matla, offset by higher production at Leeuwpan and Belfast.

Sales volumes decreased by 4% to 40.5Mt, mainly as a result of lower Eskom demand, partly offset by higher domestic sales due to export coal being diverted to the local market.

Coal revenue decreased 18% to R37 million, largely driven by a decrease in revenue from commercial mines due to lower export prices and volumes. Higher domestic prices were offset by lower domestic volumes.

Coal EBITDA decreased by 36% driven mainly by lower commercial revenue (-R8 248 million), higher operational costs (-R1 170 million) mainly as a result of higher overburden removal at Leeuwpan and Belfast, inflationary pressures (-R922 million) driven mainly by electricity tariff increases above the PPI inflation rate. This was partly offset by lower buy-in costs from Mafube due to the lower prices (+R2 693 million), lower royalties (+R795 million) and more favourable fair value adjustments realised on investments and forward exchange contracts (+R802 million).

Energy business performance: Revenue from the energy business improved by 16% driven by improved wind conditions. The energy business’ EBITDA margin was stable at 80% [FY22: 80%] underpinned by the annuity nature of the long-term offtake agreement.

Our energy business generated 727 GWh of electricity, an 8% increase from the prior year (FY22: 671GWh) due to improved wind conditions, despite the 15 GWh generation loss at one of the wind assets due to an Eskom distribution line fault that occurred earlier in the year.

Its operating wind assets project financing of R4 348 million [FY22: R4 554 million] will mature and be fully settled by the end of 2031. The energy business’ solar assets project financing which is in the process of being drawn down will mature and be fully settled by the end of 2042.

Tsengwa concluded, “We remain committed to our Sustainable Growth and Impact strategy as we transition towards becoming a more diversified business through a disciplined capital allocation framework while balancing sustaining our coal business, investment in our growth strategy, consistent returns to stakeholders, and leveraging our strong balance sheet. That being said, our strength lies in the women and men who, year-in and year-out, work tirelessly to contribute to the value of your business.”